“Mutual funds are outdated.” “ETFs are the only smart choice.” “Expense ratios are a scam.”

If you’ve heard these bold claims on YouTube or social media lately, you’re not alone. But is there truth behind the noise?

Let’s break it down and understand the real differences, advantages, and misconceptions about Mutual Funds and Exchange Traded Funds (ETFs) — and why both are valuable tools when used with purpose and understanding.

🧠 ETF vs Mutual Fund: A Quick Primer

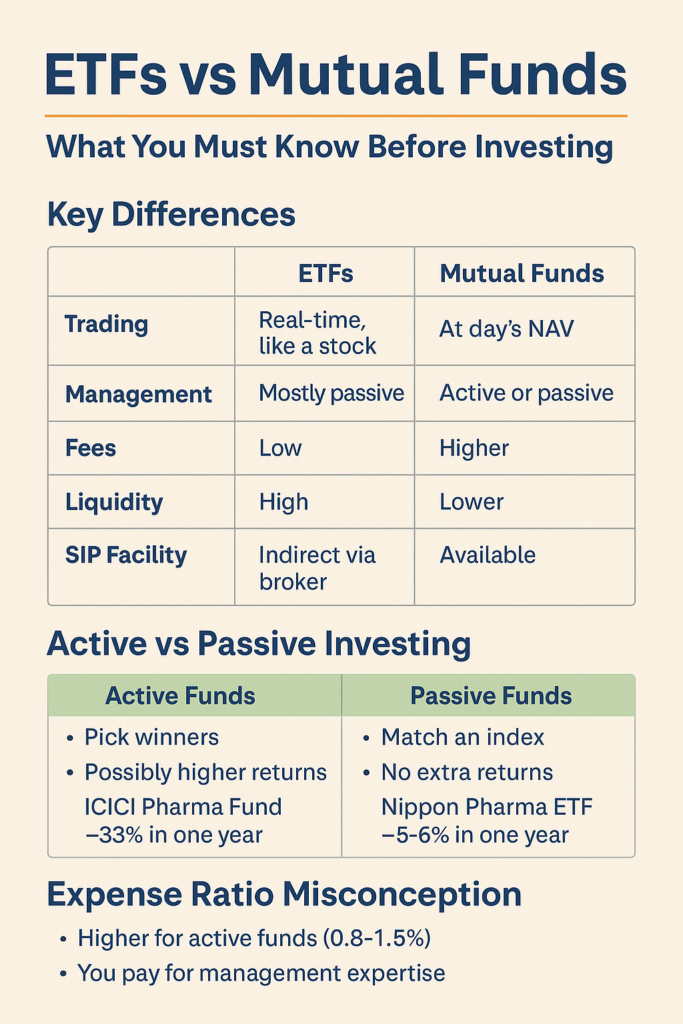

| Feature | Mutual Funds | ETFs |

|---|---|---|

| Trading | End-of-day NAV-based | Real-time trading like a stock |

| Management | Actively/Passively managed | Mostly passive (index-tracking) |

| Fees | Higher expense ratios (active funds) | Low expense ratios |

| Liquidity | Processed by AMC once per day | Traded live on stock exchanges |

| SIP Facility | Widely available | Not natively available (workaround via broker) |

| Demat Required | No | Yes |

🎯 Myth-Busting: “Mutual Funds Are Bad” — Really?

Recently, a major finance influencer released a video pointing fingers at mutual funds, claiming that they “failed investors on 4th June 2024”, the day markets dropped nearly 8%. He argued that ETFs gave better entry points, while mutual funds delayed NAV allotment, potentially leading to losses.

But let’s look at the full picture:

✅ What Actually Happened on June 4, 2024?

- Markets crashed nearly 8% intraday, but mutual fund NAVs are calculated at end-of-day prices — as always.

- ETFs, on the other hand, are market-traded instruments, so investors could buy them at lower prices during the crash.

- Hence, ETFs gave short-term intraday advantage — but does that mean mutual funds are flawed? No.

🚨 The Problem with This Argument:

- Mutual Funds are long-term wealth-creation tools, not intraday trading instruments.

- Judging them based on a single-day event is like evaluating a test match based on one ball.

- NAV allotment delays are by design, not a flaw. The cut-off rule ensures fairness in transactions.

🎓 Active vs Passive Management: Know the Game

🧠 Mutual Funds = Active Management (mostly)

- Fund managers actively pick and choose stocks, exit underperformers, and allocate dynamically.

- This explains why many active funds outperform benchmarks, especially in Mid Cap, Small Cap, or Sectoral funds like Pharma, Infra, or PSU.

📌 Example:

ICICI Prudential Pharma Fund returned 33% in one year, while Nippon Pharma ETF gave just 5–6%, despite tracking the same sector.

Why? Because ICICI’s active strategy worked better.

⚙️ ETFs = Passive Management

- ETFs mostly mirror indices like Nifty 50, Nifty Pharma, or Nifty PSU.

- They don’t pick winners or rotate holdings — just track.

- Hence, ETFs usually won’t beat the index, but they also won’t lag (unless there’s tracking error).

💰 Expense Ratio: Misunderstood Metric

A common myth:

“Mutual funds are expensive — they eat up your returns!”

🔍 Let’s clarify:

| Fund Type | Expense Ratio (approx.) | Why? |

|---|---|---|

| Active Mutual Fund | 0.8% – 1.5% | Pays for experienced fund managers, research, dynamic strategy |

| Index Mutual Fund | 0.1% – 0.3% | Low cost, passive strategy |

| ETFs | 0.05% – 0.2% | Cheapest, but no active management |

So yes, you pay more for active funds, but if the fund is consistently outperforming, then you are paying for performance.

📌 Just like you pay more for an experienced surgeon — you’re not just paying for the cut, but the judgment.

📊 When Should You Choose Mutual Funds? When Are ETFs Better?

| Situation | Ideal Choice |

|---|---|

| Want a simple SIP-based long-term plan | Mutual Funds |

| Believe in sector rotation and alpha | Active Mutual Funds |

| Looking for low-cost, index-based investing | ETFs or Index Funds |

| Comfortable with intraday trading | ETFs |

| Want to benefit from short-term dips | ETFs (with caution) |

| New investor without a demat account | Mutual Funds |

🔔 Final Thoughts: Don’t Pick Sides — Pick Purpose

Both ETFs and Mutual Funds are tools.

Like a screwdriver vs a drill, it’s not about which is better — it’s about what you’re trying to build.

- Mutual funds offer long-term consistency, active insights, and SIP convenience.

- ETFs offer cost-efficiency, real-time control, and trading flexibility.

❌ Don’t get influenced by half-truths.

🎯 Instead, build a strategy that aligns with your goals, risk tolerance, and time horizon.

✅ Summary Checklist

| ETF | Mutual Fund |

|---|---|

| Passive (mostly) | Active or Passive |

| Real-time buying/selling | NAV-based end-of-day pricing |

| Low cost | Higher cost, but with expert input |

| Great for market-savvy investors | Great for disciplined wealth-building |

| Requires demat | No demat required |

🖋️ Closing Note

Financial freedom isn’t achieved by blindly following trends — it’s built on education, clarity, and discipline.

So next time someone says “ETFs are better than mutual funds,” ask them:

“For whom? And for what purpose?”