The 50-30-20 Rule: Does It Really Work? (With Real-Life Examples and Tips)

When it comes to personal finance, budgeting is the foundation for achieving financial stability and long-term goals. One of the most popular and straightforward budgeting frameworks is the 50-30-20 rule. But does it really work in real life? Let’s dive deep into this approach, analyze its effectiveness with practical examples, and explore tips to adapt it to your lifestyle.

What is the 50-30-20 Rule?

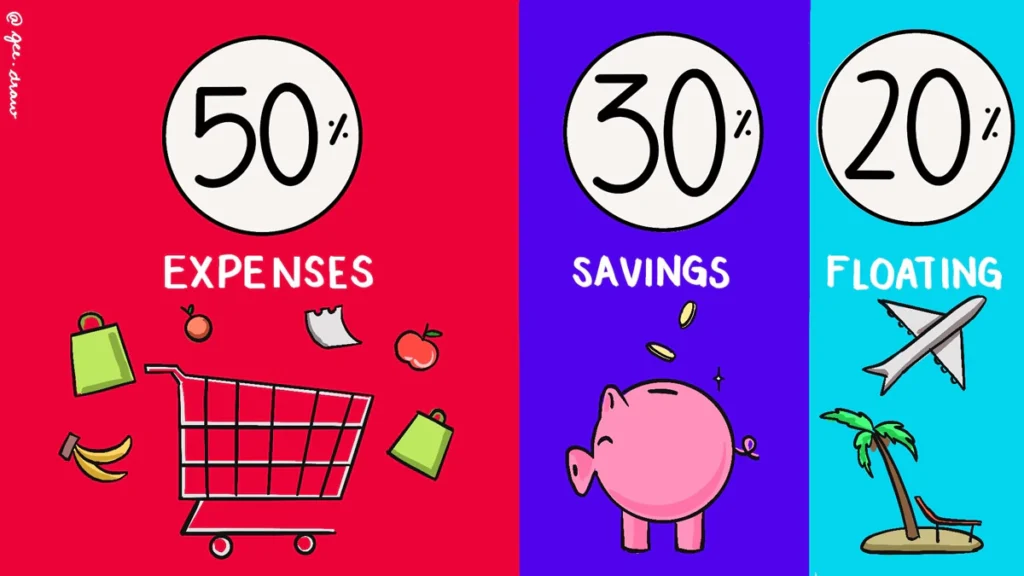

The 50-30-20 rule is a simple budgeting method designed to help individuals allocate their income efficiently across three broad categories:

- 50% Needs: Half of your income should go toward essential expenses—things you can’t live without. This includes rent, groceries, utilities, transportation, insurance, and minimum debt payments.

- 30% Wants: Allocate 30% of your income to discretionary spending—things that improve your quality of life but aren’t strictly necessary. Examples include dining out, entertainment, hobbies, travel, and subscriptions.

- 20% Savings and Debt Repayment: The final 20% is dedicated to financial goals, such as building an emergency fund, investing, retirement planning, or aggressively paying off debt.

Does the 50-30-20 Rule Work?

The 50-30-20 rule provides a solid foundation for managing your finances, but its effectiveness depends on individual circumstances. Let’s break it down:

Strengths of the 50-30-20 Rule:

- Simplicity: Easy to understand and implement, making it a great starting point for beginners.

- Flexibility: Broad categories allow for personalized adjustments based on your financial goals.

- Balance: Encourages both financial responsibility (needs, savings) and enjoying life (wants).

Limitations of the 50-30-20 Rule:

- Not Universal: High-cost-of-living areas or low-income earners may find it unrealistic to keep essentials within 50% of their income.

- Savings Might Fall Short: If you’re aiming for aggressive financial goals like early retirement, 20% savings may not be enough.

- Unclear Boundaries: Differentiating between “needs” and “wants” can sometimes be subjective.

Real-Life Example of the 50-30-20 Rule in Action

Let’s take the case of Aarav, a 30-year-old software engineer earning ₹60,000 per month in India.

Aarav’s Budget Breakdown:

- 50% Needs (₹30,000):

- Rent: ₹15,000

- Groceries: ₹5,000

- Utilities (electricity, water, internet): ₹3,000

- Insurance (health, term): ₹2,000

- Transportation: ₹5,000

- 30% Wants (₹18,000):

- Dining Out: ₹6,000

- Subscriptions (Netflix, Spotify): ₹1,000

- Gym Membership: ₹2,000

- Travel Fund: ₹5,000

- Gadgets/Shopping: ₹4,000

- 20% Savings (₹12,000):

- Emergency Fund: ₹5,000

- Mutual Funds (SIPs): ₹5,000

- Retirement Fund (PPF): ₹2,000

Outcome:

Aarav successfully meets his monthly needs while saving consistently for the future and enjoying his hobbies. However, in a high-cost city like Mumbai, Aarav’s rent might exceed 50%, requiring adjustments.

Adapting the 50-30-20 Rule to Your Life

If you find the 50-30-20 rule doesn’t fit your financial situation perfectly, here are ways to adapt it:

1. Adjust the Ratios

- High-Cost-of-Living Areas: Allocate 60% to needs, 20% to wants, and 20% to savings.

- Aggressive Savers: Reduce discretionary spending (e.g., 50-20-30) to boost savings.

2. Prioritize Debt Repayment

- If you’re burdened with high-interest debt, dedicate part of the “wants” budget to paying it off faster.

3. Combine Categories

- Combine “wants” and “savings” during lean financial periods. For example, spend only 70% on essentials and savings until your income increases.

4. Track and Adjust

- Use budgeting apps like YNAB, Mint, or Walnut to monitor your spending and make adjustments as needed.

Tips for Successfully Using the 50-30-20 Rule

- Automate Savings: Set up automatic transfers to a savings account or mutual fund to ensure you’re meeting your financial goals.

- Distinguish Needs from Wants: Be honest with yourself about what’s truly essential. For example, a gym membership might be a want unless it’s critical for your health.

- Review Periodically: Reevaluate your budget every 6 months or after major life changes (e.g., job loss, marriage, relocation).

- Plan for Irregular Income: For freelancers or business owners, base your percentages on an average monthly income.

Final Verdict: Does the 50-30-20 Rule Work?

The 50-30-20 rule is a powerful starting point for managing your finances. It encourages balance, simplicity, and discipline in budgeting. However, it’s not a one-size-fits-all solution. By tailoring it to your income, goals, and circumstances, you can create a budget that works for you while staying financially healthy.

Remember, the key to success lies in consistency. Start with the 50-30-20 rule, adapt it as needed, and watch your financial health improve over time. Happy budgeting!