Meta Description: Discover the best sectors to invest in India in 2025. Explore future-ready industries like green energy, EVs, AI, real estate, and more for high-growth opportunities.

India’s economy is poised for resilient growth in 2025, with GDP projections hovering around 6.5%, despite global macroeconomic uncertainties. For savvy investors, this opens up a wealth of opportunities across key high-growth sectors. In this blog post, we highlight the top investment opportunities in 2025 and the sectors in India that promise robust returns and long-term potential.

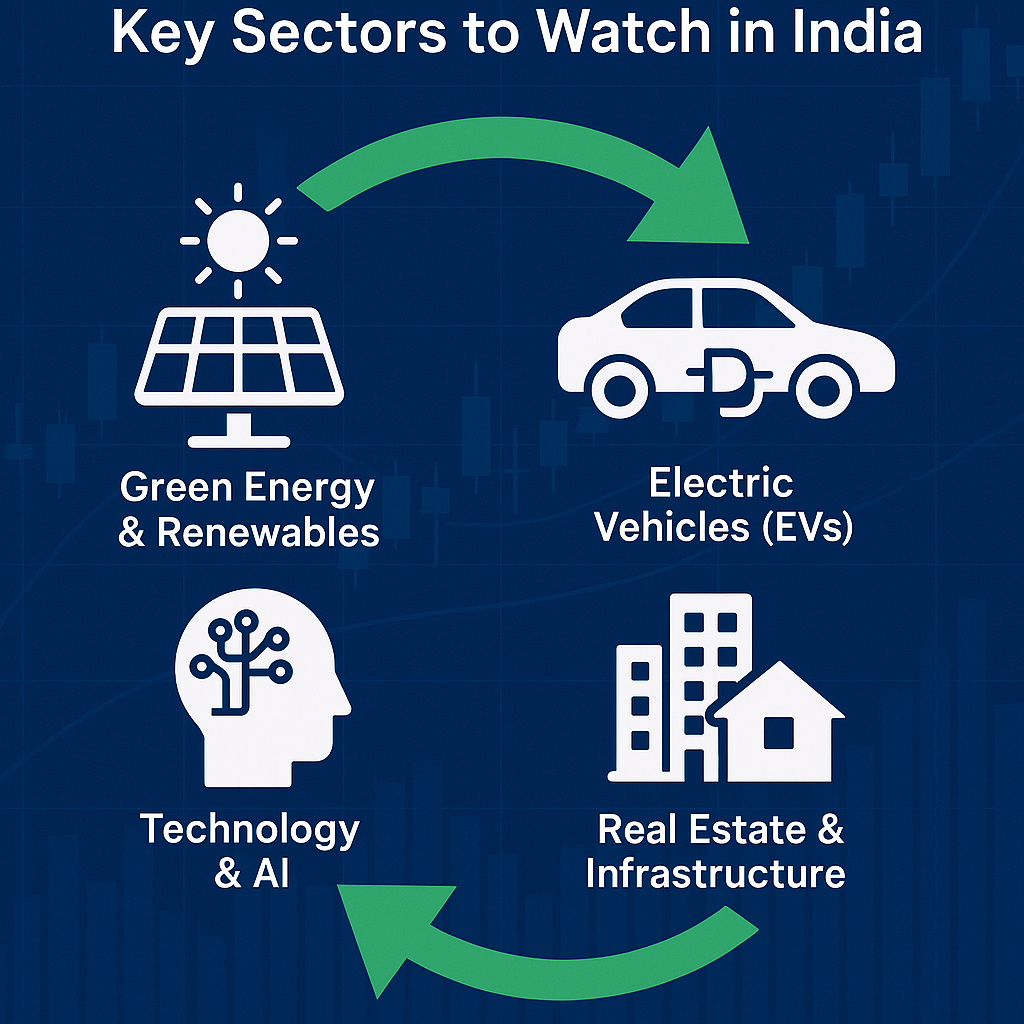

1. Green Energy & Renewable Sector

With India committed to achieving Net Zero emissions by 2070 and aggressively pushing renewable energy targets, the green energy sector is a goldmine for future investments. The government’s Production-Linked Incentive (PLI) schemes for solar manufacturing and green hydrogen are expected to accelerate this transformation.

Top picks to consider: Adani Green Energy, Tata Power, IREDA

Why invest:

- Massive push toward clean energy infrastructure

- Increasing adoption by corporates

- ESG investing tailwinds

Keywords: green energy stocks India 2025, clean energy investment India

2. Electric Vehicles (EVs)

The EV revolution is gaining momentum in India with policy support from the FAME-II scheme and rapid urban adoption. India’s EV market is projected to grow at a CAGR of over 40% by 2030.

Notable players: Tata Motors, Mahindra Electric, Ola Electric, Hero Electric

Why invest:

- Supportive government incentives

- Rising fuel prices and consumer shift to EVs

- Battery and charging infrastructure expansion

Keywords: EV sector investment opportunities India, electric mobility, EV stocks India

3. Technology & Artificial Intelligence (AI)

With global IT outsourcing rebounding and India becoming a hotspot for AI innovation, the technology sector remains a stronghold for investors in 2025. Indian SaaS and AI startups are gaining international traction, and IT majors are investing heavily in GenAI capabilities.

Top stocks: Infosys, TCS, Persistent Systems, Zensar Technologies

Why invest:

- AI integration across sectors

- Rising global demand for Indian tech services

- Government backing under Digital India 2.0

Keywords: tech stocks India 2025, AI innovation India, IT sector growth India

4. Real Estate & Infrastructure

India’s real estate sector is undergoing a structural transformation driven by urbanization, infrastructure investment, and affordable housing demand. The Smart Cities Mission and PM Awas Yojana are key catalysts.

Why invest:

- REITs offering attractive returns

- Growth in Tier 2 and Tier 3 cities

- Rising rental yields and commercial property demand

Keywords: real estate investment India 2025, smart cities India, REITs India

5. Upcoming IPOs & Emerging Businesses

2025 is expected to see a wave of IPOs from Indian unicorns and growth-stage companies. Investors with an eye on the future can participate in wealth creation from early-stage investments.

Watchlist IPOs: Ola Electric, Swiggy, FirstCry, Navi

Why invest:

- Access to disruptive business models

- High-growth potential in consumer tech

- Portfolio diversification with emerging themes

Keywords: upcoming IPOs in India 2025, Indian startup IPOs, unicorn listings India

Final Thoughts

As we step into 2025, identifying the right sectors is crucial for capitalizing on India’s growth story. Diversification, patience, and sectoral tracking will be key to navigating volatility while unlocking long-term wealth.

Which sector are you most bullish on for 2025? Share your views in the comments below!